In today’s world, where everyone is looking for additional ways to earn money, paid survey platforms have become a real lifesaver for many. These sites not only offer an opportunity to earn extra income – they open the door to a world where your opinion really has weight and, importantly, value. Imagine: you’re sitting at home, sipping tea, and at this time your thoughts and ideas are helping companies improve their products and services. In return, you receive not only moral satisfaction but also tangible rewards.

But let’s dig deeper. What really drives this market? Why do some platforms become popular while others fade into oblivion? The answer is simple: it’s all about the payment system. Payment mechanisms are the very “skeleton” on which the entire structure of trust between the user and the platform rests. Agree, you’re unlikely to want to spend your precious time filling out questionnaires if you’re not sure you’ll receive the promised reward for it.

In this analysis, we’ll embark on an exciting journey through the world of paid surveys. We’ll break down various payment models, compare payment methods, discuss minimum thresholds for withdrawing funds, and evaluate the speed and reliability of payments. We’ll also look at factors influencing user choices and try to understand how to maximize your earnings by choosing the right survey sites.

Are you ready to learn how to turn your opinions into real money? Then let’s start our research!

- Classification of paid survey platforms by payment structures

- Direct payment survey platforms

- Reward-based survey platforms

- Hybrid payment models

- Detailed comparison of payment methods on different survey platforms

- Electronic wallets (PayPal, Skrill)

- Rewards in the form of gift cards

- Direct bank transfers and prepaid cards

- Minimum payout requirements

- Understanding threshold levels

- Comparison of low and high payout thresholds on popular survey sites

- Platforms with high thresholds

Classification of paid survey platforms by payment structures

Before we delve into the details, let’s understand what types of platforms exist in the paid survey market. Understanding these differences will help you make the right choice and maximize your earnings.

Direct payment survey platforms

Let’s start with the most obvious and perhaps the most attractive option for most users — platforms with direct payment.

Imagine you came to work, worked your hours, and at the end of the day received your salary in cash. This is roughly how platforms with direct payment work in the world of online surveys. You fill out a questionnaire, and bam! — the money is already in your account. No complicated schemes, no confusing point conversion systems. Everything is simple and transparent.

This approach has a number of undeniable advantages. Firstly, you always know how much you’ll earn for each survey. This allows you to easily plan your time and efforts. Secondly, the absence of the need to convert points or scores into real money significantly simplifies the process and reduces the risk of losing part of your earnings with an unfavorable exchange rate.

Moreover, direct payments are usually made through popular electronic wallets, such as PayPal, or even directly to a bank account. This is not only convenient but also significantly increases the level of trust in the platform. Agree, when you see that money is coming directly to your account, it inspires much more confidence than promises of some virtual rewards in the future.

Examples of such platforms are Pinecone Research and ySense, which are known for their reliability and punctuality in processing payments.

Reward-based survey platforms

In the world of paid surveys, not everything is measured in money. Some platforms prefer to reward their users in other ways. Instead of direct cash payments, they offer various bonuses such as gift cards, points, or vouchers. These rewards can be exchanged for goods, services, or discounts at various stores.

This approach may seem less attractive at first glance, but it has its advantages. For example, some platforms may offer exclusive discounts or access to products that are difficult to find in open sale. In addition, for shopping enthusiasts, the opportunity to accumulate points for a desired purchase can be even more motivating than small cash payments.

Examples of such platforms are MyPoints and LifePoints, which offer various reward options and favorable point conversion rates.

Hybrid payment models

Hybrid models are a kind of Swiss army knife in the world of paid surveys. They offer users the opportunity to receive both cash rewards and various bonuses in the form of gift cards or points. It’s as if your job offered you a choice between cash salary and corporate benefits — sounds tempting, doesn’t it?

Branded Surveys and Swagbucks are bright representatives of such platforms. They allow users to earn both real money and points that can be exchanged for various rewards. Want to get money on PayPal? Please. Prefer to save up for a gift card from your favorite store? No problem.

Such flexibility is a real gift for users with different preferences. Someone may use the earned money to pay bills, while others will prefer to accumulate points for a large purchase or gift. This is not just convenient — it gives a sense of control over your earnings, which is extremely important in the modern world where everyone strives for financial independence.

Detailed comparison of payment methods on different survey platforms

Now that we’ve figured out the main types of platforms, let’s dive into the details and look at the various payment methods they offer. Choosing the right payment method can significantly affect your experience with the platform and, ultimately, your earnings.

Electronic wallets (PayPal, Skrill)

In the era of digital technologies, electronic wallets have become a real breakthrough in the world of online payments. And the world of paid surveys is no exception.

PayPal is perhaps the most famous name in the world of electronic payments. Its popularity in the survey industry is simply off the charts, and for good reason. Imagine that you’ve just finished a survey, and literally within a few minutes, the money is already in your account, ready to use. Sounds fantastic? For PayPal users, this is everyday reality.

What makes PayPal so attractive for survey platforms and their users? Firstly, it’s speed. Instant transactions mean you can get your money almost immediately after completing the survey. Secondly, it’s global accessibility. No matter where you are — in New York or a small town in Australia — PayPal works everywhere there’s internet.

But most importantly, it’s security. PayPal uses advanced encryption technologies to protect your financial data. This is especially important in the world of online surveys, where you often deal with unfamiliar platforms.

Platforms like InboxDollars and OpinionOutpost have made PayPal their priority payment method precisely because of these advantages. They understand that convenience and security of payments are key factors in attracting and retaining users.

Rewards in the form of gift cards

If electronic wallets are about speed and universality, then gift cards are about shopping pleasure and exclusive offers.

Platforms like Toluna and PrizeRebel stand out from competitors with their impressive assortment of gift cards. Imagine a virtual shopping mall where you can choose gift cards from Amazon, Walmart, Starbucks, and dozens of other popular brands. Sounds tempting, doesn’t it?

Such diversity is not just a nice bonus — it’s a strategic move. Platforms understand that different users have different preferences. Someone dreams of a new gadget from Amazon, others prefer to treat themselves to a cup of coffee at Starbucks, and still others are planning a big purchase at Walmart. By providing a wide choice, these platforms are essentially saying: “We value your opinion and want the reward to be truly enjoyable for you”.

Moreover, gift cards are often offered with additional bonuses or discounts. For example, you might find that a $25 gift card costs only 2000 points, while the cash equivalent of $25 will cost you 2500 points. This is a kind of “cherry on top” that makes choosing gift cards even more attractive.

Direct bank transfers and prepaid cards

Now let’s talk about more traditional methods of receiving rewards — direct bank transfers and prepaid cards. These methods might seem a bit “old-fashioned” compared to electronic wallets, but they have their undeniable advantages.

Imagine that you’ve filled out several surveys, and at the end of the month you discover an additional amount in your bank account. No extra actions, no conversions — the money just appeared where you’re used to seeing it. This is exactly how direct bank transfers work on platforms like Branded Surveys.

Direct deposits are especially convenient for those who prefer to keep all their finances in one place. You don’t need to worry about transferring money from PayPal to your bank account or converting points into real money. Everything happens automatically, which saves your time and nerves.

On the other hand, prepaid cards, which are offered by, for example, Vindale Research, give you the freedom to use your earned funds as if it were a regular debit card. You can withdraw cash at an ATM, make purchases online or pay in stores — and all this without the need to have a bank account. This is especially convenient for young users or those who for some reason do not have access to traditional banking services.

Moreover, using prepaid cards can help you better control your expenses. You know exactly how much money you have on the card from participating in surveys, and you can easily track what you’re spending it on. This is a great way for those who want to allocate “entertainment money” or create a separate budget for online purchases.

Minimum payout requirements

Now that we’ve figured out the payment methods, let’s talk about what often becomes a stumbling block for many newcomers to the world of paid surveys — minimum thresholds for withdrawing funds.

Understanding threshold levels

Imagine you’re saving coins in a piggy bank. You wouldn’t take it to the bank when there are only a couple of coins, right? This is exactly how payout thresholds work on survey platforms. This is the minimum amount you must accumulate before you can withdraw your funds.

Payout thresholds play an important role in the economy of paid survey platforms. For platforms, it’s a way to optimize their payment processing costs. For users, it can be both a stimulus and an obstacle, depending on the threshold level and personal preferences.

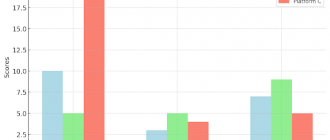

Comparison of low and high payout thresholds on popular survey sites

In the paid survey market, you can find platforms with a wide range of payout thresholds. Let’s look at a few examples:

Platforms with low thresholds, such as GrabPoints and InstaGC, allow you to withdraw funds after accumulating a very small amount — sometimes just $1 or $3. This is especially attractive for beginners who want to quickly see the result of their efforts. Imagine, you’ve just registered, completed a couple of surveys, and you can already receive your first reward! Such a quick result motivates you to continue participating in surveys and can be an excellent start for long-term cooperation with the platform.

On the other hand, there are platforms with higher payout thresholds. For example, Ipsos i-Say has set a minimum threshold of $20. At first glance, this may seem like a disadvantage, but this approach has its own advantages.

Platforms with high thresholds

High payout thresholds can evoke mixed feelings in paid survey users. On one hand, it can be a demotivating factor, especially for those who are just starting their journey in the world of paid surveys. Imagine that you’ve spent several hours filling out questionnaires, and you’re still far from being able to withdraw money. This can cause disappointment and even a desire to quit this activity.

However, high thresholds have their advantages. Firstly, they can motivate you to participate more actively in surveys to reach the desired amount faster. Secondly, when you finally reach the threshold, the payout amount turns out to be more substantial. Agree, receiving $20 or $50 at once is much more pleasant than several times $1-2.

In addition, high payout thresholds can be a sign that the platform is oriented towards more serious and dedicated survey participants. Such sites often offer high-paying tasks, which in the long run can be more profitable than frequent but small payouts.